Property Documents Description & Sample

The boom in the property sector and the fragile legal system have raised fraudulent practices related to purchase of property.

It is extremely essential that each property document be scrutinized before you set out for any property deal. Metro law Firm service to reach out to you to get your property verification services in time.

Documents Description

A Sale Deed is the core legal document that acts as proof of sale and transfer of ownership of the property from the seller to the buyer. A Sale Deed has to be mandatorily registered. It is important that before the Sale Deed is executed one should execute the sale agreement and should check for compliance of various terms and conditions as agreed upon between the buyer and the seller. Before executing the Sale Deed, the buyer should check whether the property has a clear title. He/she should also confirm if the property is subject to any encumbrance charges.

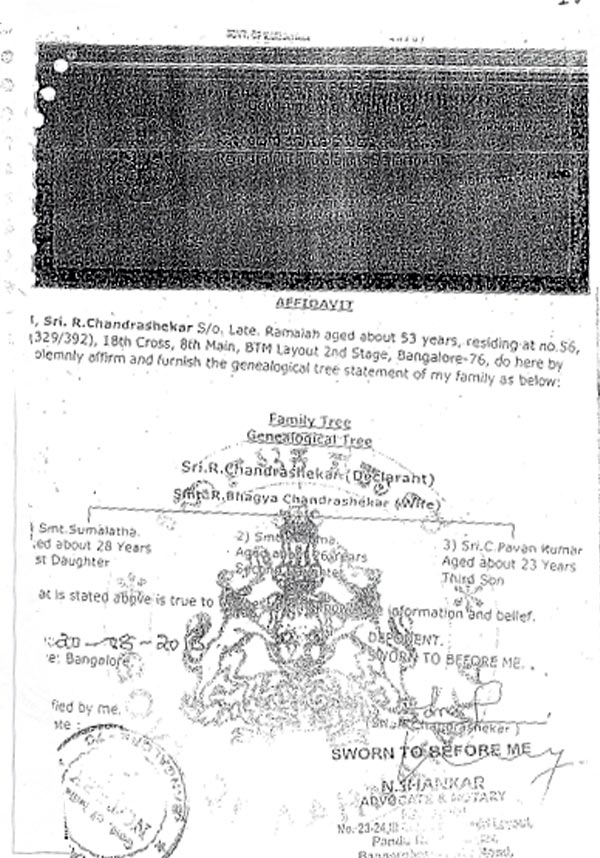

Mother Deed, also known as the parent document, is an important legal document that traces the origin/antecedent ownership of the property from the start (if the property has had various owners). It is a document that helps in the further sale of the property, thereby establishing the new ownership. In case of absence of the original Mother Deed, certified copies should be obtained from the registering authorities.

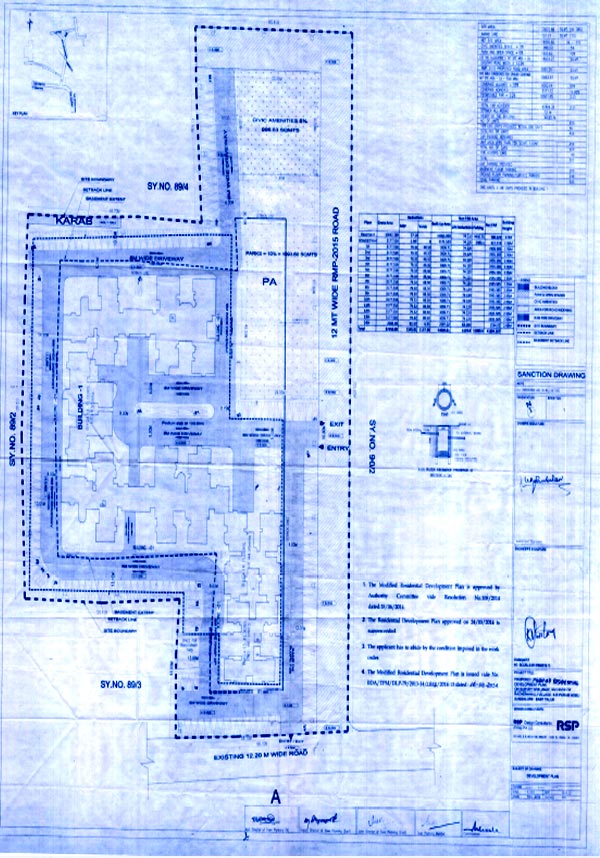

A building plan is sanctioned by the BDA (Bangalore Development Authority) or BBMP (Bruhat Bengaluru Mahanagara Palike) or BMRDA (Bangalore Metropolitan Region Development Authority) or BIAPPA (Bangalore International Airport Area Planning Authority) without which the construction of the building is illegal under the Karnataka Municipal Corporations (KMC) Act. A building owner has to get an approved plan from the jurisdictional Commissioner or an officer authorized by such Commissioner. However, the authorities sanction a building approval plan based on the zonal classification, road width, floor area ratio (FAR) and plot depth. A set of documents are required to be submitted by the owner in order to obtain a building approval plan. The documents include- Title Deed, property assessment extract, property PID number, city survey sketch (from the Department of Survey and Settlement and Land Records), up-to-date tax paid receipt, earlier sanctioned plans (if any), property drawings, 2 copies of demand drafts, foundation certificate (if any) and a land use certificate issued by the competent authority (viz., Dy. Commissioner). It is mandatory that the building owner hires a registered architect who will draw a plan meeting the applicable bye laws.

A Commencement Certificate is a legal document issued by the local authorities (BDA/BBMP & alike) after the inspection of the site. This document states that project meets the give criteria and helps in the commencement of a construction on a site by the builder. Failing to acquire a Commencement Certificate will result in the construction being considered illegal, levy penalties and can even attract an eviction notice.

With a vast amount of land being agricultural in nature in Karnataka, a Conversion Certificate is mandatory to be obtained from the legal body for the property. A Conversion Certificate is issued to change the use of the land from agricultural to non-agricultural purpose from the competent revenue authority. Further, the competent revenue authority requests the Department of Town and Country Planning to issue an NOC for the conversion of land for residential purpose.

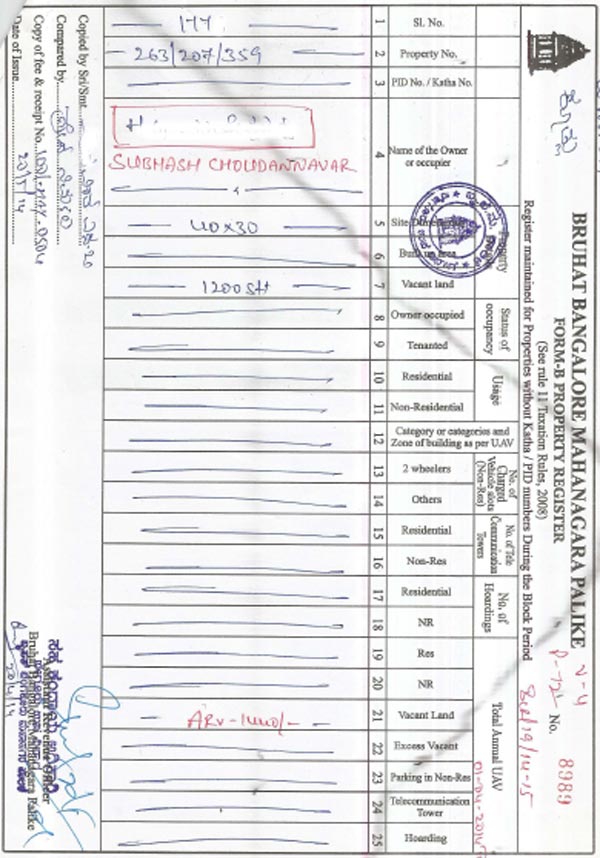

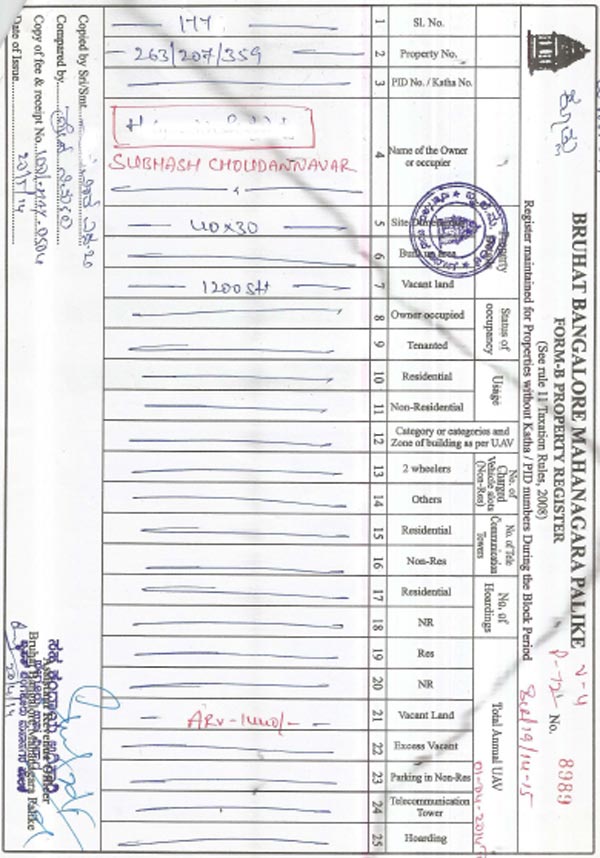

Khata is derived from the word ‘account’. It is an account of a person owning a property. It typically consists of (a) Khata Certificate and (b) Khata Extract. A Khata Certificate is mandatorily required for the registration of a new property and the transfer of a property. Khata Extract is nothing but obtaining the property details from the assessment registrar. It is needed while property buying and acquiring trade license. The Khata is widely referred to as A Khata and B Khata (Revenue records extract). ‘A’ Khata has properties listed under BBMP jurisdiction with legal property construction and ‘B’ Khata has properties under local jurisdiction with violated property constructions. One should avoid buying a B Khata property as it will be deemed as an illegal construction. Nevertheless B Khata may be converted to A Khata under certain schemes by paying penalty to the Government.

Encumbrance means charges in the ownership or liabilities created on a property that is held against a home loan as security. An EC consists of all the registered transactions done on the property during the period for which the EC is sought. Simply put, it is a certificate sought for a particular period evidencing the property purchase/sale, the presence of any transaction or mortgage. One should submit a copy of the Sale Deed to obtain an EC. A person applying for an EC should fill in the Form 22, affix a non-judicial stamp and submit it to the jurisdictional sub-registrar’s office. Complete residential address, property survey number, property location, the sought period, property description, its measurements and boundaries should be mentioned in the Form. A nominal fee amount will be charged on a yearly basis. The time taken to obtain an EC will be between 3-7 working days or more depending on the period sought.

Betterment charges are also known as improvement fees/development charges that are to be paid to the BBMP before a Khata can be issued. Currently the developers are entitled to pay a fixed amount as betterment charges to the municipal body. A receipt of the same should be obtained at the time of property buying.

Receipts for property tax bills ensure that taxes for the property are paid up-to-date to the government/municipality. For properties falling under the BBMP jurisdiction, it is mandatory for property taxes to be paid up to date so a buyer could get a Khata issued in his name. It is therefore important for the buyer to make enquiries with the government/municipal authorities to ensure that all the dues are cleared by the seller. The buyer should ask the seller for the latest original tax paid receipts and bills and check the details of the owner’s name, the tax payer’s name, and the date of payment on the receipt. If the owner does not have the tax receipt, the buyer can contact the municipal body along with the survey number of the property to confirm the ownership of the land. Nevertheless, the buyer should also ensure that other bills such as the water bill, electricity bill etc. are paid up-to-date.

A Completion Certificate is issued by the municipal authorities denoting that the building is in compliance with their rules in terms of height, distance from the road, and is constructed as per the approved plans etc. This document is important at the time of purchasing a property and seeking a home loan.

When the builder applies for this Certificate, an inspection is carried out by the authorities to ensure that the construction meets all the specified norms. This certificate is obtained after the completion of the construction. It is important at the time of buying a property, seeking a home loan, before the builder allows people to take possession of the property and, for the transfer of Khata. Basically, it certifies that the project is ready for occupancy.

A POA is a legal procedure used to give authority to another person by the property owner on his/her behalf. One can either give a Special Power of Attorney (SPA) or a General Power of Attorney (GPA) to transfer one’s rights over one’s property.

Mutation is the change of title ownership from one person to another when the property is sold or transferred. By mutating a property, the new owner gets the title of the property recorded on his/her name in the land revenue department and the government is able to charge property tax from the rightful owner.

There are two types of mutations.

Mutation of Agricultural lands &

Mutation of Non-Agricultural Lands. Example : Flats, independent houses, residential plots, godowns, etc.,

In case of Agricultural lands, mutation is must. Without mutation the land title will not pass to the new owner. Mutation should be entered in the revenue records. The owner’s name which is recorded in the revenue records is referred as ‘Pattadhar’. In scenarios like land acquisition by the Government then the compensation is paid only to the individual whose name is present in the revenue records.

In case of non-agricultural lands, failure to mutate does not take away your right in the sale deed

One needs to get mutation done and get the new owner details updated in the revenue records maintained by civic bodies like Municipalities, Panchayats or Municipal Corporations.

When Mutation of property can be done?

You need to get the transfer of title of property (mutation) done in the below circumstances to avoid any legal disputes in the future;

After buying/purchasing a property.

After inheriting a property through a Will or without a Will.

After acquiring a property through a Gift Deed.

Documents Sample

Katha Extract specimen Copy

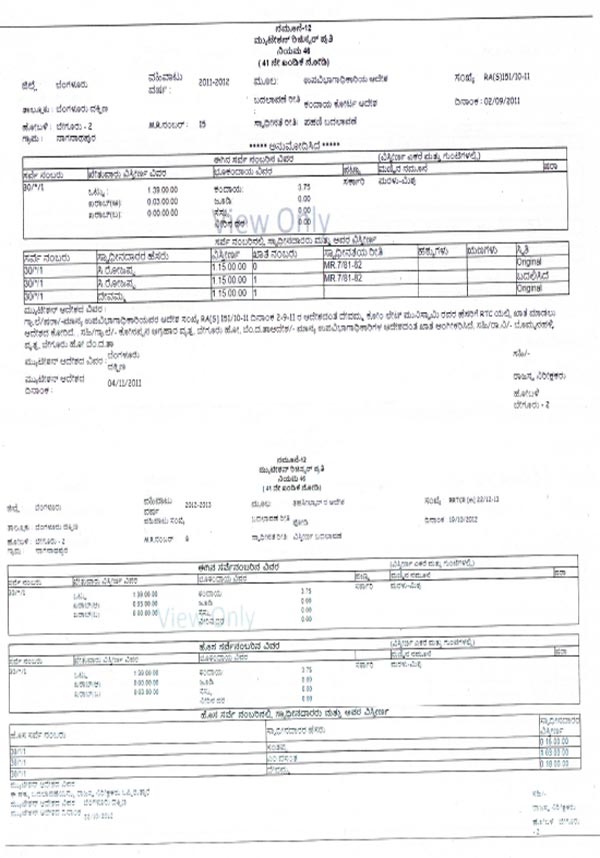

Mutation Registrar specimen copy

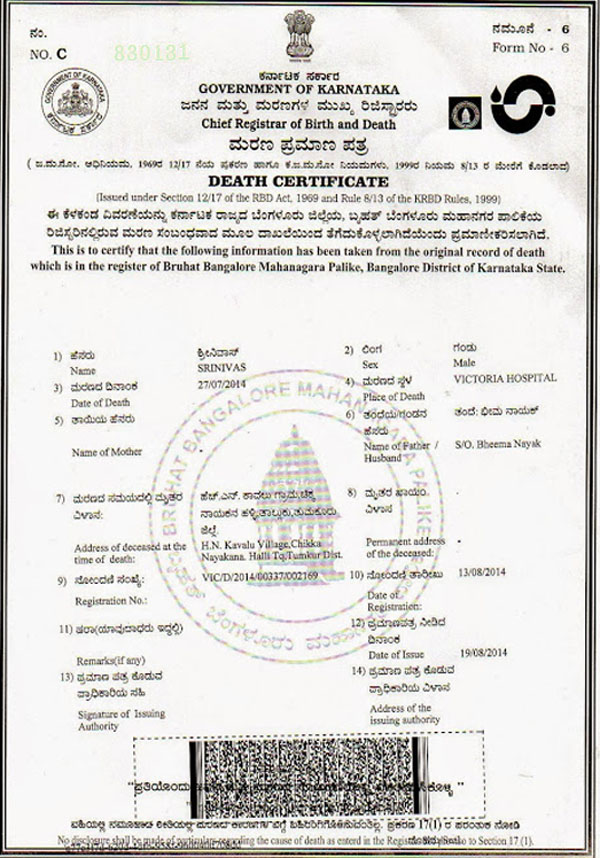

Death Certificate Copy

Fire station NOC

Fire Station Department NOC Specimen Copy

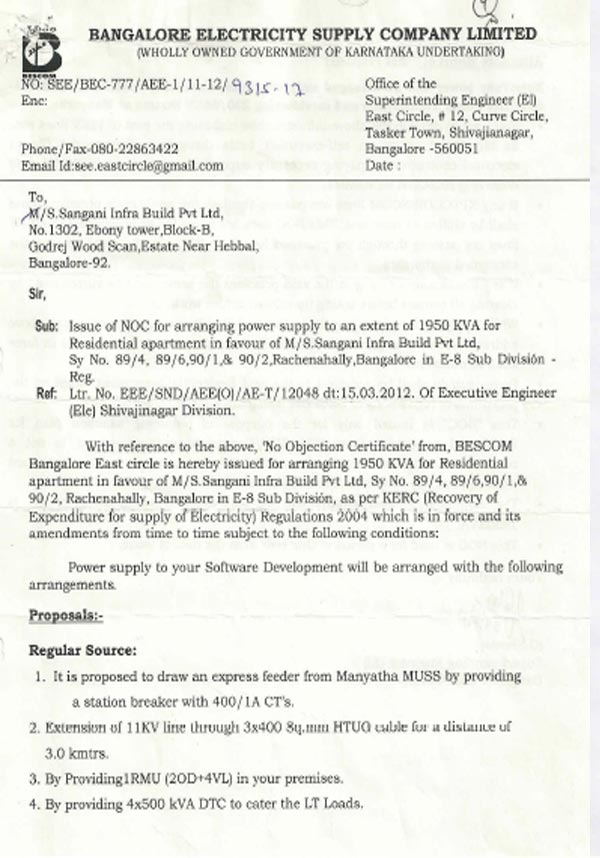

BESCOM Department NOC specimen Copy

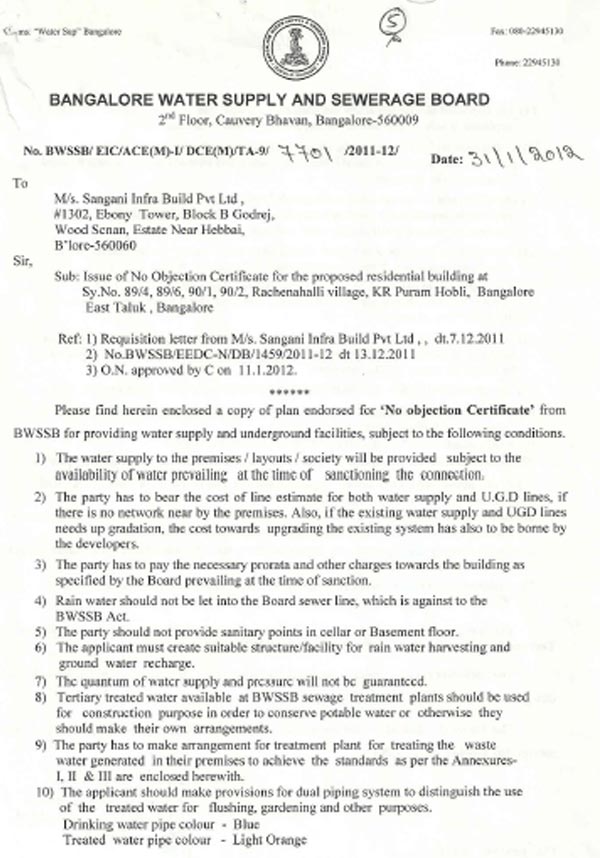

NOC form Water Supply Department Specimen copy

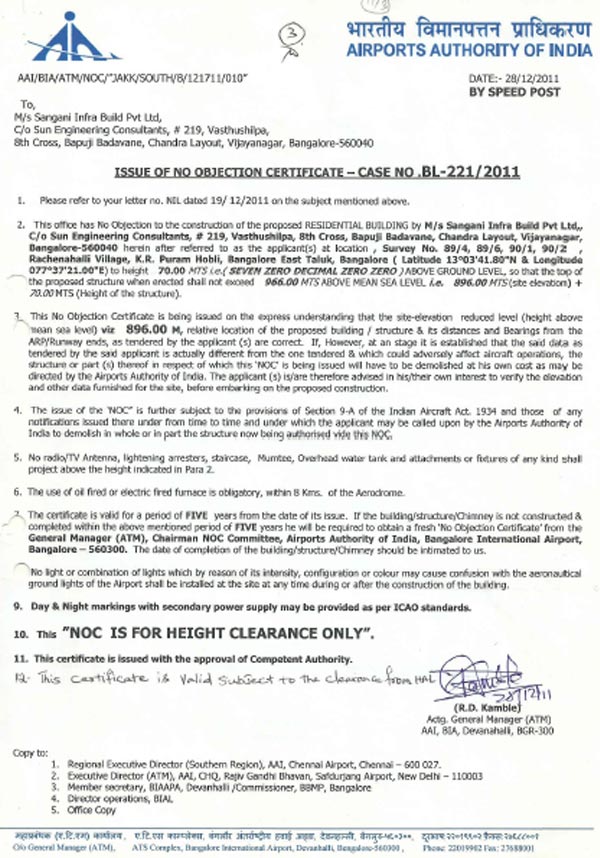

NOC From Airport Authority specimen Copy

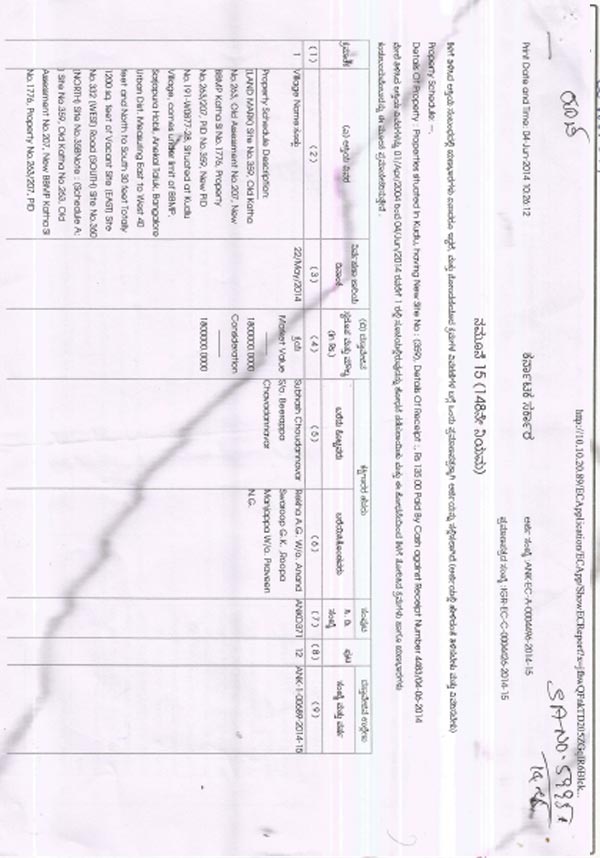

Encumbrance Certificate Specimen copy

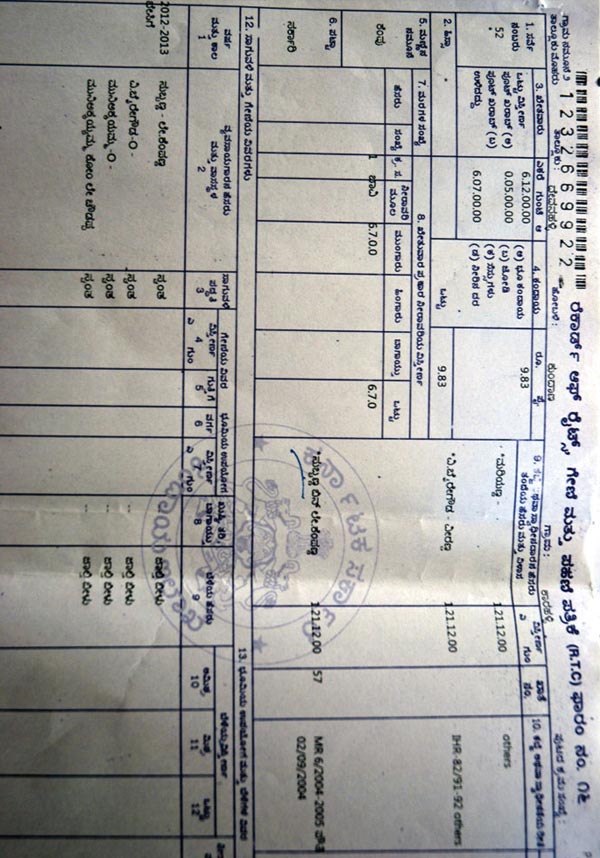

Khata Extract BBMP

RTC / Pani

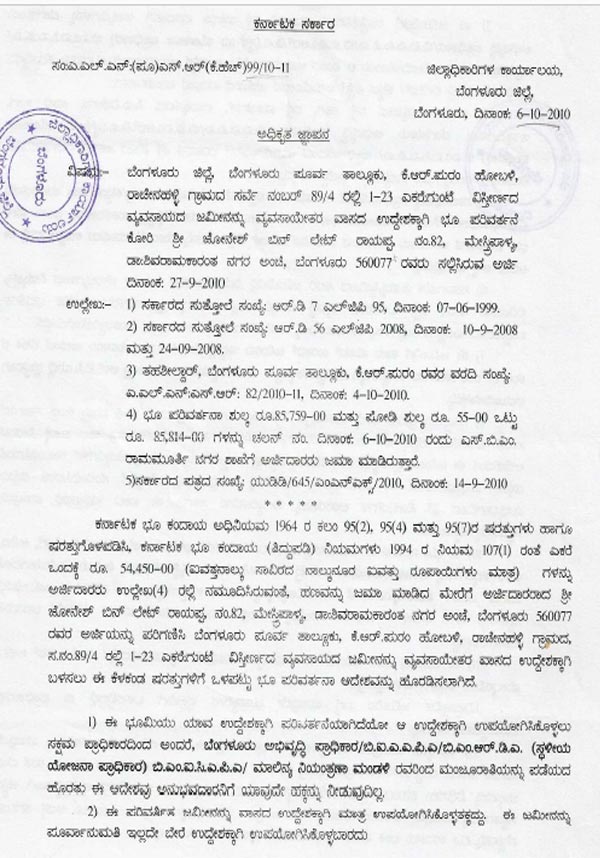

Conversion from agricultural to non-agricultural land

Plan Approval Copy from the developer / Builder